Australian Currency vs USD

Previously I wrote that the New Zealand exchange rate with the United States is tied to the Australian rate. From 30 June 2015 to 30 April 2025 the NZD depreciated 16.5% while the AUD depreciated 18.5%.

OFX Data

Canada and the UK depreciated by a similar amount, but the graphic lines pretty much move togther between NZ and Australia. So what makes the AUD line move, and why is the foreign exchance so depreciated? There four main causes:

· Sales of iron ore and coal, with China as the major market;

· US monetary prices vs. Australia;

· Domestic economic challenges in Australia;

· Strong US dollar and the global risk.

Sales of Iron Ore and Coal to China

When exports are earning superior money to the US the money rate tends to rise. Australia’s primary export is resources, and the rate rose during 2021-22.

Reserve Bank of Australia

Australia trade in exports with China is far superior to the US.

Reserve Bank of Australia

In 2023 iron ore represented 22.6% of Australian exports, and coal represented 19.2%. China was 36.6% of foreign trade destination.

Reserve Bank of Australia

China has had a price increase in USD in ’21 and ’22, but the price pre and post that period is less impressive, and the growing China building depression suggests worse times.

Reserve Bank of Australia

Reserve Bank of Australia

Metallurgical coal has a similar pattern, though the reasons are different ...

Reserve Bank of Australia

Reserve Bank of Australia

China has shunned metallurgical coal from Australia, but the price reflects the global supply.

Reserve Bank of Australia

Thermal coal is the same if not worse than metallurgical.

Reserve Bank of Australia

The price of all other resouces in negative or constant, and China’s building boom is over. Although China has a self-perception of medium prosperity, outside views paint a dimmer view. China’s situation will cause it to lower prices on primary produce, from Australia and elsewhere.

Wall Street Journal

The AUD exchange rate with the USD advanced in 2021-22, but in looks like its declining going forward.

US Monetary Prices vs. Australia

The monetary prices determan dollar demand – the higher the price the more demand for the dollar.

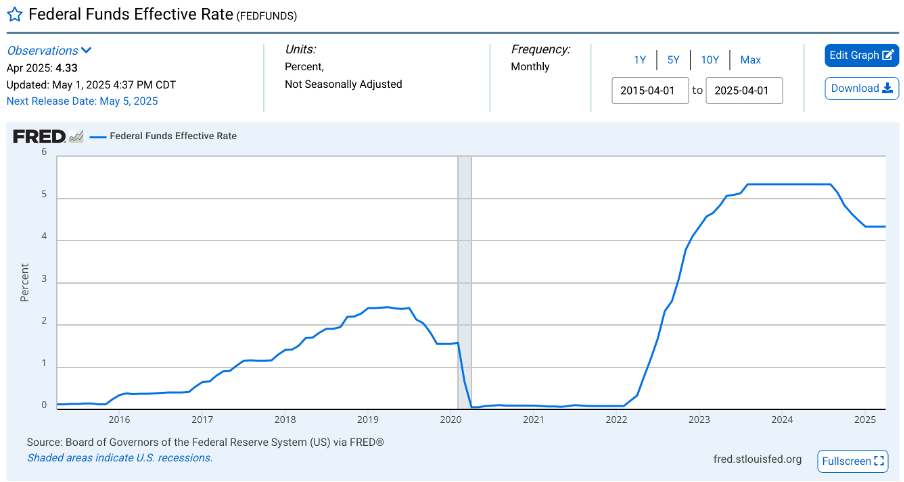

The Federal Bank in the US began raising rates in 2016, but lowered them in 2020-22 due to the Covid-19 crises. In 2023 it began raising them again due to inflation and have just adjusted them of late.

Federal Reserve Bank of St Louis

This rate is reflected in mortgage rates, as well as other rates.

Federal Reserve Bank of St Louis

In Australia, the rate according to the Australian Bank started high in 2015-16, became less during 2019, declined as in the US due to Covid-19, and then rose but approximately 0.25% lower than the US.

Reserve Bank of Australia

This contributed to mortgage rates 0.5% - 0.75% lower in Australia.

Reserve Bank of Australia

Because the monetary rates were and are higher in the US the USD has found getter favour than the AUD.

Domestic Economic Challenges in Australia

Australia’s economic growth has been sluggish, with real GDP barely growing and domestic demand weak in recent years. The RBA noted acute pressure on household budgets and a slowing economy, contributing to expectations of rate cuts that further devalue the AUD.

World Bank

Reserve Bank of Australia

High debt levels, mass immigration, and housing market pressures have been cited as structural factors weakening the AUD.

Reserve Bank of Australia

Strong US Dollar and the Global Risk

The USD has been bolstered by strong US economic data, including robust job growth (e.g., 256,000 jobs added in December 2024) and persistent inflation concerns, reducing expectations of significant Fed rate cuts in 2025. This has kept the USD near a two-year high, pressuring the AUD.

The AUD is highly sensitive to global risk sentiment, often depreciating during periods of market uncertainty (e.g., global financial crisis, COVID-19, 2025 tariff fears). Since 2015, events like trade disputes, geopolitical tensions, and US policy shifts have driven risk-averse flows into the USD, a safe-haven currency, at the expense of the AUD.

Summary and Potential Changes

Clearly Austalia is in a fix – long term because of the export blend, weak economy, the prescent of immigrants, and short term because of President Trump’s tarrifs. However there are some things which Australia can do if it wants to reajust the AUD rate compared to the USD:

· If the government and bureacracies let the market rate adjust – mortages, business lending - the AUD will rise. This will in turn encourage foreign direct investments ...

· The business must come back to manufacturing to complement it’s services, and focused on higher tech to improve productivity – medical supplies, defence hardware, space equipment, and alternative energy. Methods like subsidies and other goverment and private methods are in place (for example Future Made in Australia Plan with $22.7 billion in investment, the Manufacturing Modernisation Fund with grants between $100,000 and $1 million for SME’s). Are the methods sufficient enough to make a difference or at least make it fast enough to affect the AUD and therefore the NZD exchange rate with the USD in a timely way? Can the goverment (Federal and State) do more to fully co-operate with business – present and new – to bang through some innovations with scale opportunities (for example the National Reconstruction Fund investments in worthy innovation)? And is industry developing investments in manufacturing, stimulated by governments for credits on taxes on capital investments (for example the R&D tax incentive program)?

· Reduce business regulatory burdens. For current and new busiunesses regulations such as energy costs (in Australia there is a large range of energy, electricity, gas, etc. regulations and rules contacts), supply chains arrangements (like the Buy Australian Program, National Rail Manufacturing Program), building standards (counted 45+ government/government connected stipulation agencies), OH&S and environmental studies deter manufacturing. Simplifying regulations and creating business-friendly policies can make Australia more attractive for investment.

New Zealand relies on Australia for improvement in its NZD exchange rate with the US – here’s hoping the Australian attidude will overcome the barriers, with perhaps a little help from New Zealand.